If a death has occurred, you have to take care of a lot of organizational matters as a bereaved in addition to coping with grief. This also includes what should happen to the deceased person's car. We have all the information for you.

Who can sell the car of a deceased person?

If you were named by a will or automatically enter as an heir because you are related to the deceased person in a direct line (child or grandchild), then you also have the authority to sell the car from the testator's estate. In both cases, you have the right, but if you are not related to the person, it will be a little more difficult.

Sale as an unrelated heir:

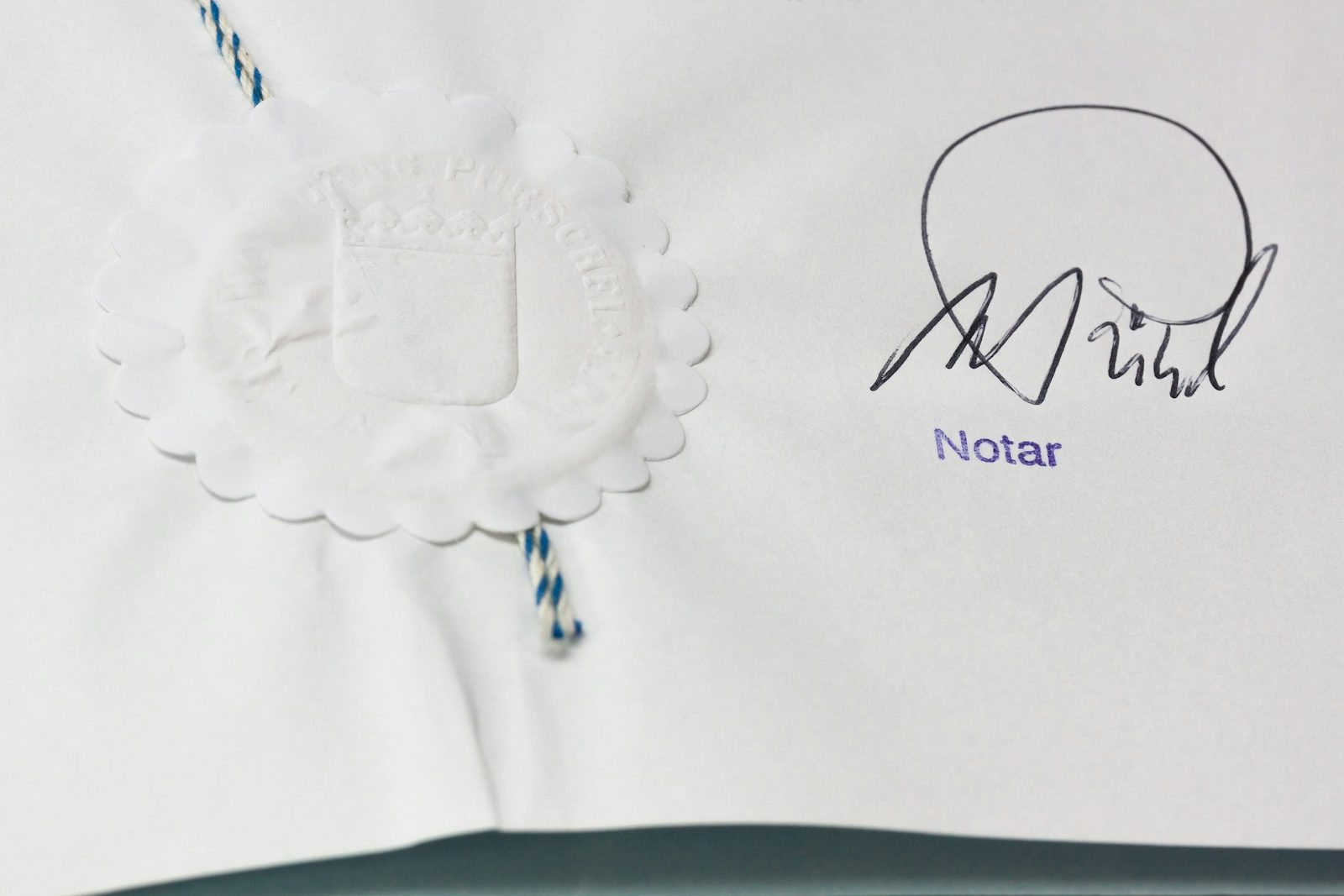

If a will has been issued in your favor, then you are legally on the safe side. However, as an unrelated person, it is difficult to claim the car from the estate of the deceased. You should take the will to the competent probate court and have a certificate of inheritance issued. This gives you and a potential buyer the security that you are entitled to sell the car.

Selling as a direct relative:

In this case, selling an inherited vehicle is relatively easy. However, especially in the case of a community of heirs, you should make sure that you can prove that you are the heir to the car. If there is a will that explicitly grants you the car, the matter is clear. If this is not the case, the community of heirs must agree on who will receive which item from the estate. Until this is settled, individual heirs cannot take over the sale of the car on their own.

Who owns the car after death without a will?

A car is included in the estate just like other assets. If the testator has not written a will, the car is also part of the assets that are subject to the rules of legal succession.

Can you sell an inherited car without a certificate of inheritance?

Normally, a certificate of inheritance is always required to sell an inherited car. A certificate of inheritance allows heirs to take any number of legal steps – such as selling a car. Therefore, the first step is to take care of the certificate of inheritance. You can obtain this from the competent probate court, which requires some documents to issue it. These are

- Death certificate

- Testament

- Declaration of Succession

It can take some time for the certificate of inheritance to be issued. It is advisable not to dare to sell until then. The certificate of inheritance ensures that you are the legitimate heir and thus offers buyers the security that you are allowed to sell the car.

We said that normally a certificate of inheritance is required. If you are directly related to the deceased person and it is clearly stated in the will that you inherit the vehicle, an additional certificate of inheritance is not necessary.

By the way: If you don't want to sell an entire car collection, the car sale is also tax-free.

Is a car part of the estate?

Yes, a car is part of the estate and is therefore part of the estate of a deceased person. If you are part of a community of heirs, the first thing to clarify is who inherits how much. If you inherit a financed car, then the financial obligations are also transferred to you - that is, you have to continue to pay off the car.

In Germany, there is an inheritance tax allowance of 12,000 euros for movable objects, including a car. If the car is worth more, you have to pay tax on the rest.

Selling a car from the estate – necessary documents

Once the certificate of inheritance has been issued, you will need the following documents to sell the vehicle:

- Vehicle registration document

- Vehicle registration document

- TÜV report

- Checkbook

- Certificate of Inheritance

Of course, you can also sell a car without a TÜV, but you must state this detail unambiguously.

If there is no checkbook or the last inspection was a very long time ago, you should have maintenance carried out to ensure that the vehicle is in good condition. If you want to sell a defective car, you have to specify this exactly when selling. If you have concealed defects, the buyer can withdraw from the car purchase contract.

Deregister a car after death

If you're considering selling, you'll need to deregister the car. Even if you want to keep the car for the time being but don't want to drive it, you should deregister it as soon as possible to save on tax and insurance.

If you want to sell the car quickly, it is important that deregistration is tackled as soon as possible after the death.

When does the car of a deceased person have to be deregistered?

The legal definition of the period is very vague. Section 13 of the Vehicle Registration Ordinance states that the change in owner data must be reported immediately to the vehicle registration authority, otherwise you are committing an administrative offence. What exactly is "without delay" is not elaborated on.

We would say that it is probably best to cancel within 14 days. The certificate of inheritance should also have been issued during this period.

Can I deregister my late father's car?

Yes, as a direct heir, you can deregister your deceased father's car. You will need the certificate of inheritance and/or the will and the electronic insurance confirmation (eVB number).

If the car is to be sold, you deregister it so that you don't have a vehicle owner in the vehicle registration document. This reduces the value in the event of a later sale.

Re-registering a car after death - what do you have to consider?

If you want to drive the inherited vehicle yourself, it is necessary to re-register the car. Normally, you do not need to present a certificate of inheritance to re-register.

Re-registering a car in the event of death – important deadlines

Until all organizational tasks are completed, there is usually little time to mourn. But it's important that important deadlines don't miss – that only makes things more complicated in the end.

Anyone who has been named as an heir has a so-called duty to provide information. This means that the deceased's insurance companies – including the car insurance company – must be contacted immediately. If the car has not yet been paid off because the deceased person financed it, the payment obligations are transferred to you as the heir. Contact the bank as soon as possible. Selling a financed car is usually not easy.

If you want to sell the car, the existing insurance can be used for another month. The buyer must take care of a new insurance policy within this period.

Re-registering an inherited car, what documents are necessary?

In the case of a change of registration, you only need the documents that are necessary for a normal change of registration, even in the case of inheritance. These would be registration certificate parts I and II, proof of valid technical inspection and an eVB number issued to you as an heir.

How long can you drive a deceased person's car?

As long as the vehicle is registered, the current insurance cover continues to exist. However, you should inform the insurance company as soon as possible, because the insurance premium usually changes with the death of the previous owner. You probably don't have the same driving experience and you may not have a garage – this will affect the posts.

Car insurance in the event of death – does the car remain insured?

Yes, because car insurance is property insurance, the car is insured and not the vehicle owner. Accordingly, the insurance remains in place even after the death of the owner and is automatically transferred to the heirs. However, you must inform the insurance company of the death of the policyholder as soon as possible and if you want to take over the vehicle, the insurance must be transferred to you.

Driving an inherited car – can you transfer the SF class?

If you have inherited a car, you also inherit the insurance and the no-claims class at the same time – but no more than as many claim-free years as you already have your driver's license. Up to 12 months after the death of the previous policyholder, you can transfer the SF class to yourself as an heir. You must present the death certificate to the insurance company for this.

Unsure what to do with the car? Rest insurance

If you don't know yet whether you want to keep or sell the inherited car, there is the option of taking out rest insurance. To do this, you deregister your car and park it safely - preferably in a covered space on private property. Then you can take out rest insurance, which can run between 6 and 18 months and ends automatically after the specified period.